This could range from a few months to several years, depending on the investor's preferences and the nature of the investment.ġ. Time Period Under Consideration: The time period for which the MDD is to be calculated must also be specified. This data can be obtained from various financial data sources, such as stock exchanges, financial news websites, or commercial data providers. Historical Price or Return Data: To calculate MDD, historical price or return data for the investment in question is needed. Calculation of Maximum Drawdown Data Requirements MDD plays a significant role in investment strategies and portfolio management, as it helps investors understand the historical risk of their investments.īy incorporating MDD into their decision-making process, investors can better assess their risk tolerance and make informed choices about asset allocation and risk management strategies.

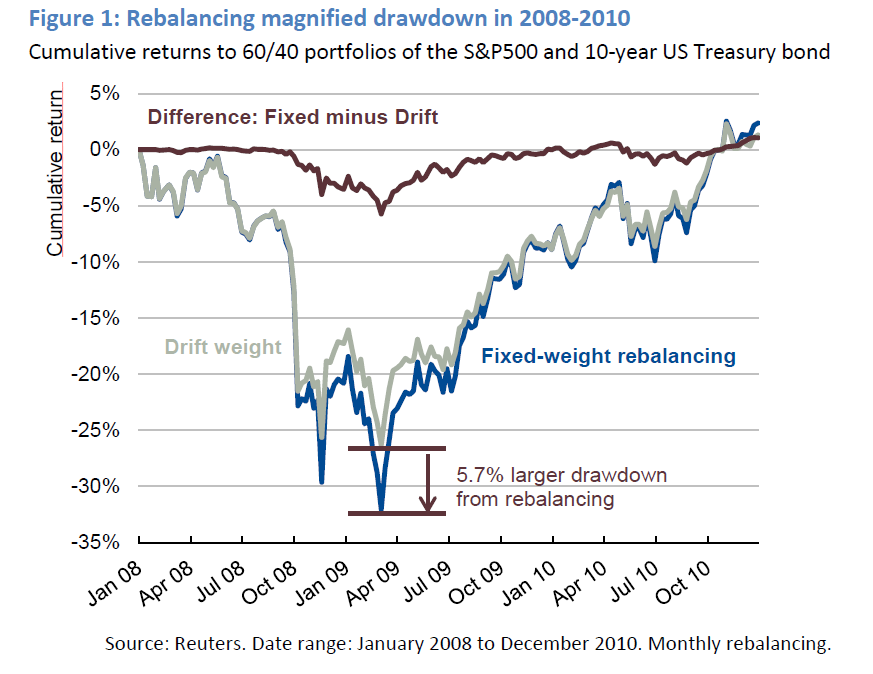

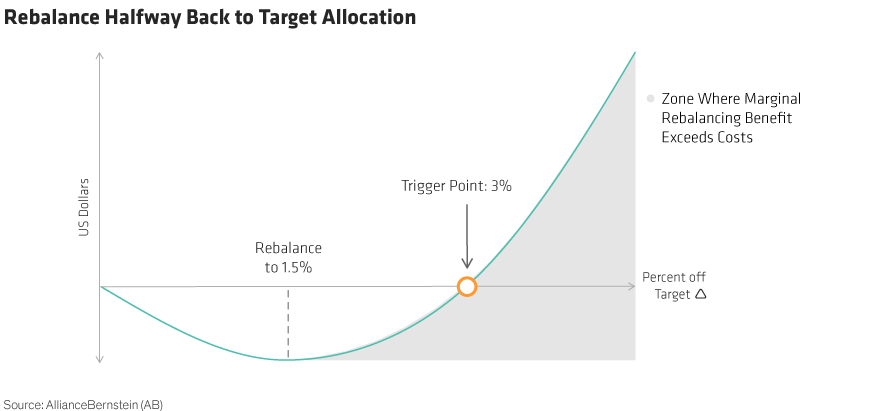

This information is crucial for investors when evaluating the riskiness of an investment and making asset allocation decisions. MDD is an important risk assessment tool because it captures the worst-case scenario for an investment, providing insight into the potential magnitude of losses during periods of market turmoil. Investors and fund managers commonly use MDD to assess the historical risk of various assets and investment strategies.

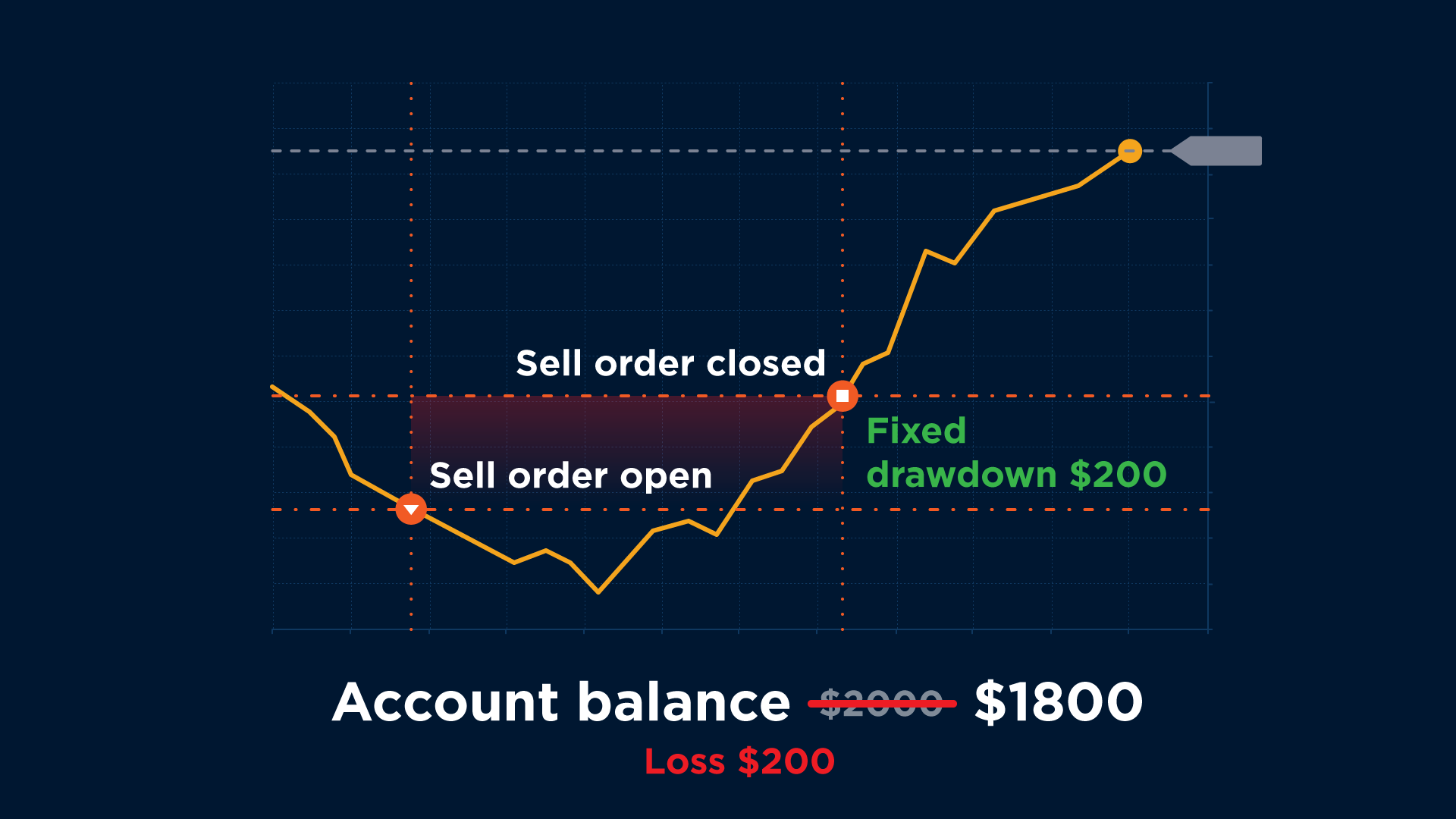

It measures the percentage loss from the peak value of an investment to its lowest point (trough) before a new peak is attained. Maximum Drawdown (MDD) is a risk metric used in finance to quantify the largest decline in an investment's value over a specified time period.

0 kommentar(er)

0 kommentar(er)